The booster for your order to cash process: SAP Receivables Management

Optimize visibility of receivables with SAP Receivables Management - the Receivables Management solution integrated with S/4HANA.

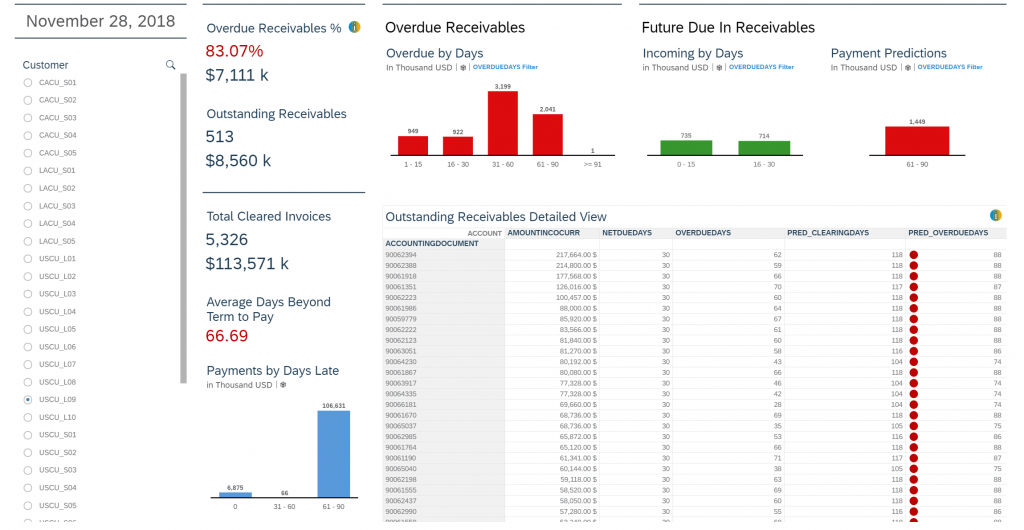

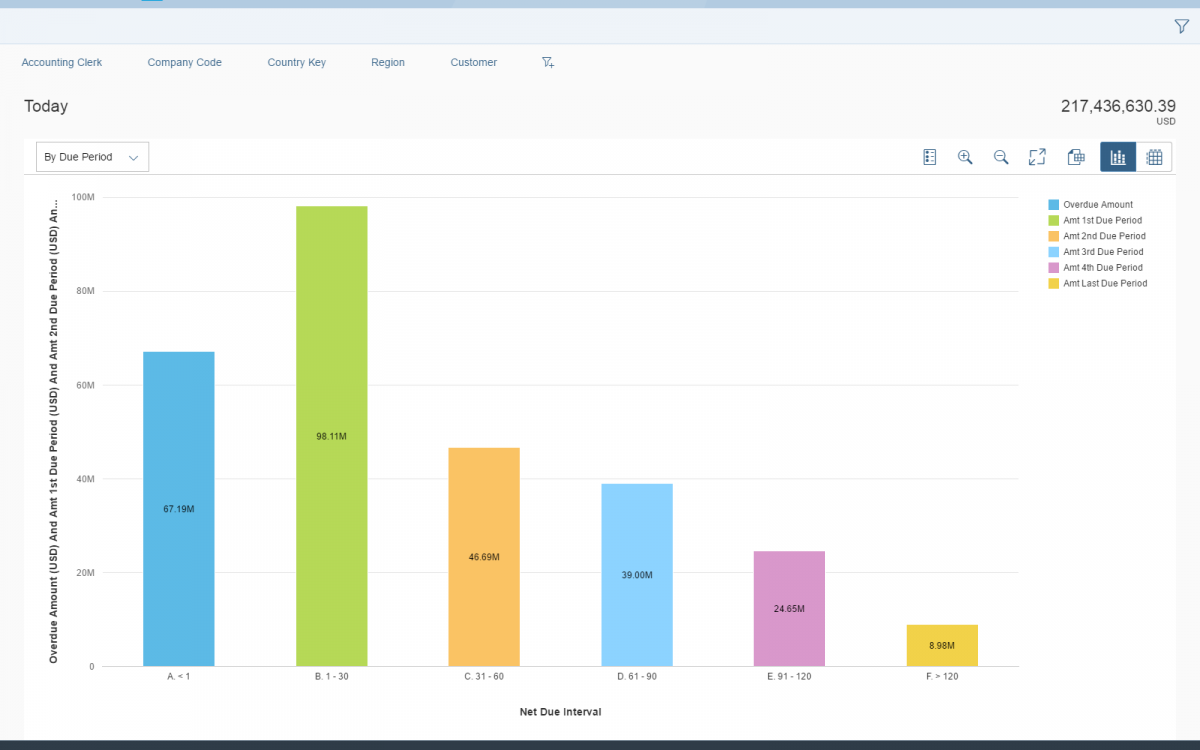

Monitor receivables in real time to respond to fluctuating markets, identify risky customers and improve your company's cash flow!

- available in the cloud or on-premise

- central, automated and intelligent receivables management

- Seamless integration into ERP, financial processes and logistics

- Improves customer experience through proactive communication and root cause clarification

for clarification cases

- improves customer service through additional information and transparency in sales

a 360° view of the customer

Overview: SAP Receivables Management Components

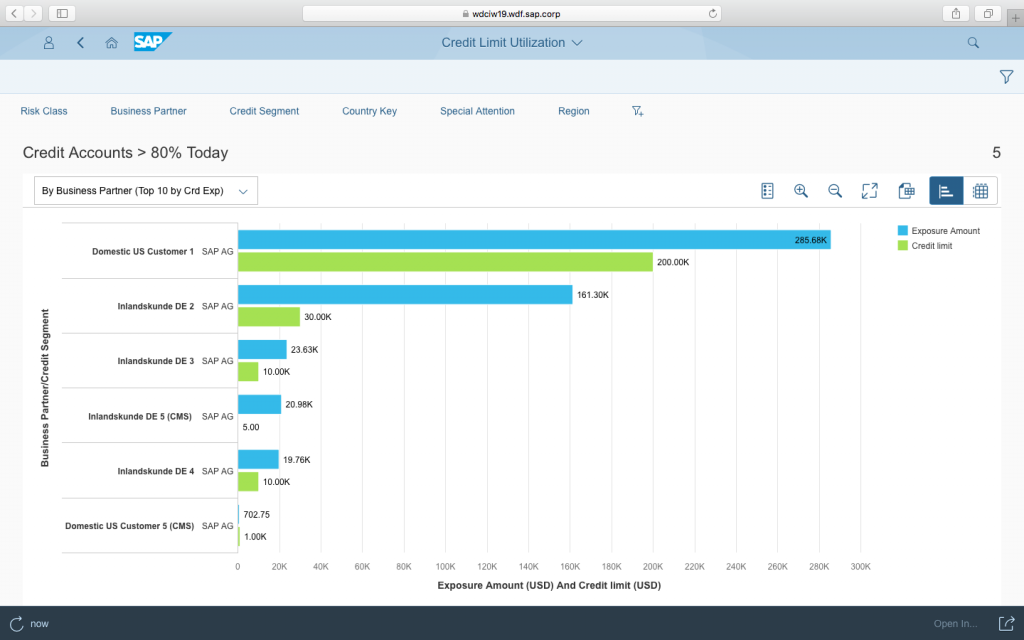

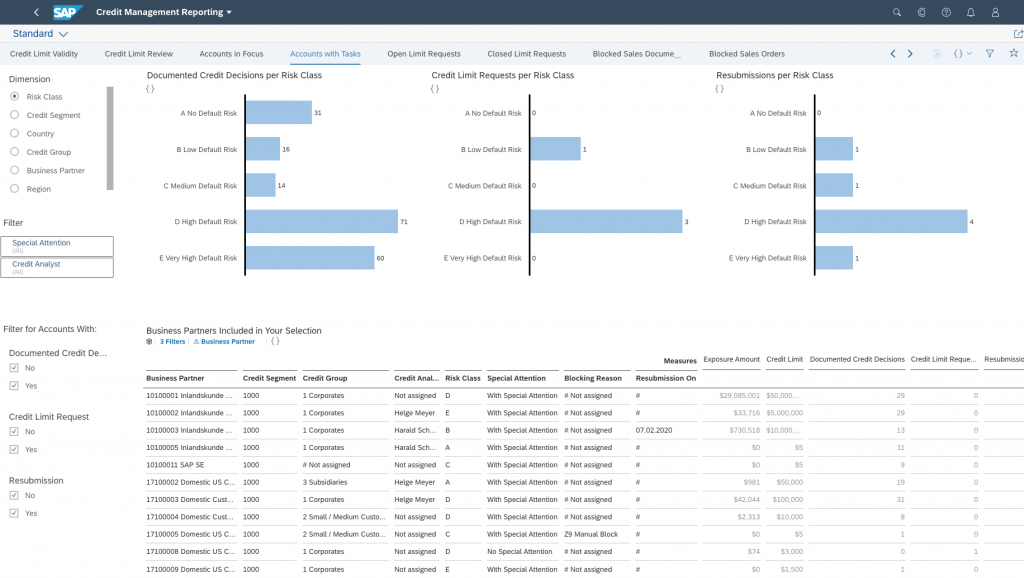

SAP Credit Management

With SAP® Credit Management, you can quickly assess a customer's risk of default and manage the company's credit lines throughout the customer lifecycle. The software allows you to automate the implementation of credit policies and manage default risk by evaluating data from various sources - including external credit reporting agencies - to make a quick decision. With its sophisticated credit rules engine, the software segments customers according to creditworthiness and payment behavior. Additionally, you can minimize your risk by more effectively managing your customers' credit lines, which are key factors in customer relationship management.

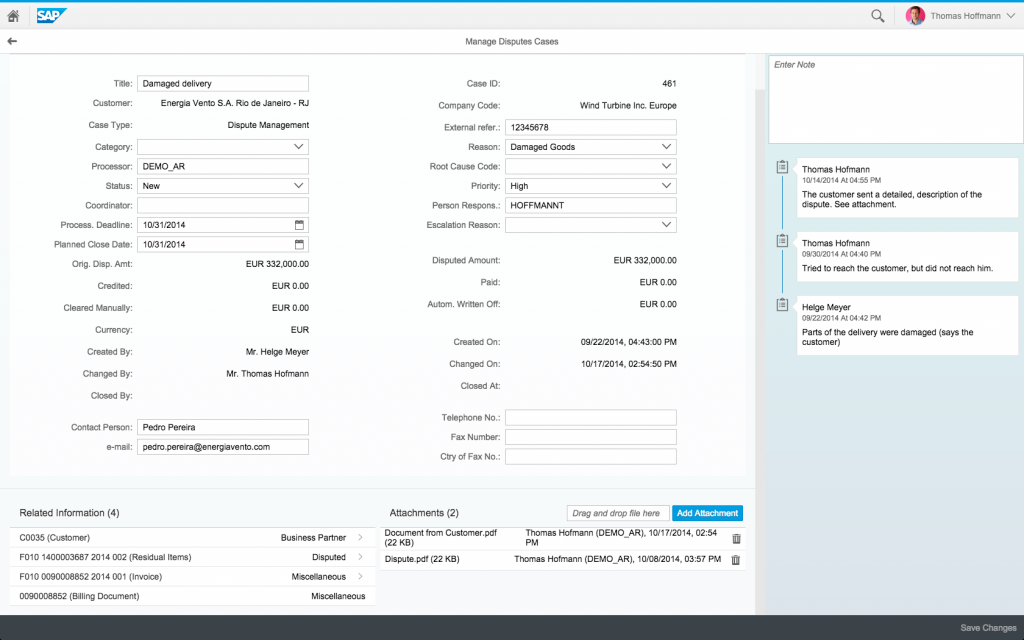

SAP Dispute Management

With the dispute management function of SAP Collections and Dispute Management, you can automate accounting disputes by making communication and collaboration across departments more efficient through an advanced workflow and automatic rule sets with their own logic and escalation levels. Since the component is fully integrated into SAP ERP Financials, the status of the dispute cases is automatically updated when customer payments are posted. In addition, you can process each dispute case according to specific codes such as price deviations, quantity and damaged goods and forward them with all attachments and documentation to the appropriate employees via alerts and workflow. With SAP Collections and Dispute Management, you benefit from faster clarification processes, significantly lower resource costs and faster debt collection.

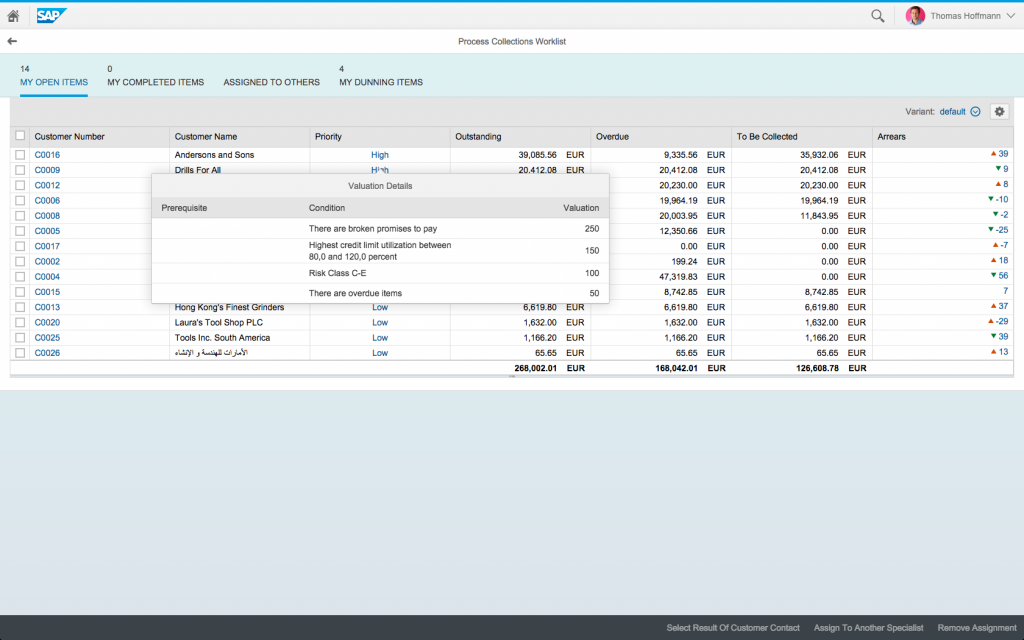

SAP Collections Management

With the receivables management functionality of SAP Collections and Dispute Management, you can proactively manage overdue receivables and prioritize collection efforts for maximum success. The software uses a collections worklist inventory with an overview of each overdue account, including outstanding invoices, disputes, and contact history. This ensures debt collectors have all the information they need to contact a customer. Additionally, agents can easily document the outcomes of each customer contact and create payment promises. When you work with SAP Collections and Dispute Management, you can achieve higher collection success rates. This accelerates cash flows, reduces VNB and minimizes the risk of bad debts.

SAP Cloud Extensions for Receivables Management

Durch die Erweiterbarkeit der SAP Cloud Platform können Sie wichtige Geschäftsabläufe täglich erfüllen und gleichzeitig planen und erweitern, um zukünftige Anforderungen zu erfüllen. Als Plattform für Erweiterung und Innovation vereinfacht SAP Cloud Platform, wie neue Technologien genutzt werden können, um Geschäftsprozesse und Funktionalität durch Intelligenz, Effizienz und mehr Benutzerinteraktion zu verbessern

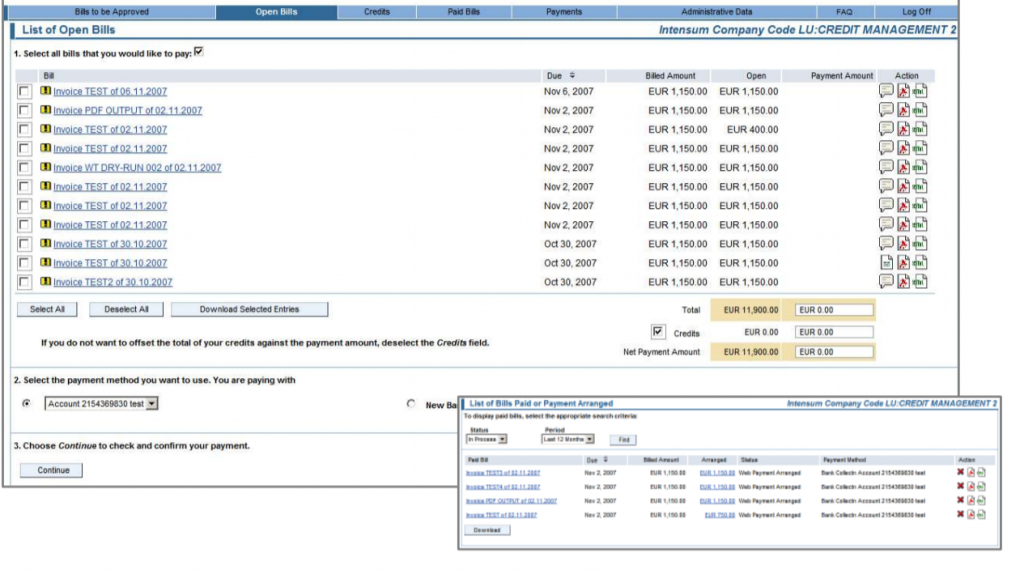

Biller / Payer Direct

The software helps you optimize payment processes and offers your customers the ability to view their account status, receive invoices and make payments online. Your customers receive information either directly through the software's web interface or through integration with your existing customer service portal. You can also leverage the tight integration between SAP Biller Direct and SAP Collections and Dispute Management to allow customers to electronically log complaints and monitor the status of existing dispute cases online. Companies that use SAP® Biller Direct can reduce billing costs, streamline receivables and payment management, and increase customer loyalty.

Electronic invoicing and streamlined payments

Your company likely uses a mix of customer relationship management solutions to manage customers more effectively and protect future revenue streams. With SAP® Biller Direct, you can leverage electronic invoicing and payments technology to expand invoicing and receivables management processes

en

en  de

de