Digital Finance with SAP S/4HANA.

intelligent Solutions for the Finance Organization of the Future.

The Challenge

CEOs today prioritize revenue growth and customer experience (CX) alongside cost control and profitability.

Finance managers and CFOs of the future and present need access to complete and forward-looking cash flow data to achieve these goals.

To achieve that Enterprises need real-time financial information to make better, more informed decisions, and technology must support end-to-end, real-time financial processes. Finance leaders must deliver clear, actionable, and forward-looking insights to business stakeholders and decision-makers.

S/4HANA Solutions for Finance & Finance Operations

S/4HANA for Financial Management is designed to remove traditional barriers between transactional, analytics and planning systems to provide instant insights and on-the-fly analysis using all levels of financial data.

It consists of a set of interconnected accounting and financial management functions that process real-time data from the business applications in an S/4HANA ERP Solution. A decision-maker, for example, can use it to model financial scenarios and build forecasts.

SAP S/4HANA Finance is part of S/4HANA, which is built on SAP HANA, SAPs in-memory database platform. By storing data in the computer's main memory rather than on disks, in-memory databases allow faster queries and can analyze more information in a timely way than the traditional databases that typically serve as the data repository of an ERP system.

With HANA at its foundation, S/4HANA integrates cross-organizational functions such as accounting and procurement into one system that combines records of business transactions with analytics.

Your Finance Transformation

The transformation of your solutions and processes in accounting, finance, controlling, accounts receivable and accounts payable, receivables management, credit management requires a lot of experience and more than just technical and functional know-how. With our transformation experience accumulated over 20 years...

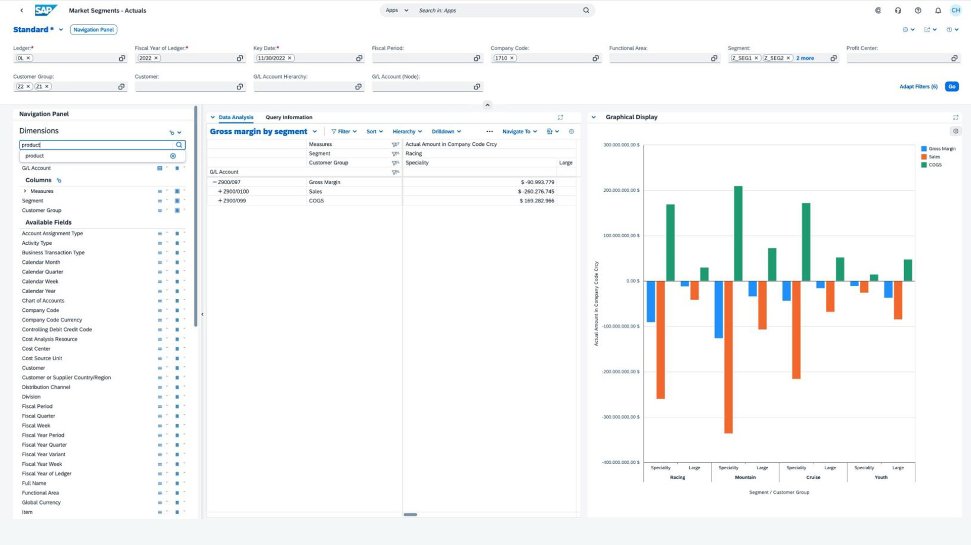

Financial planning and analysis

Data-driven decisions that improve business performance

Create, execute, and monitor financial plans organisation-wide with prebuilt business accelerators and predictive simulations.

Use prebuilt analytical reports of key figures, including drill-down capabilities to the underlying transactional data.

Make informed decisions with real-time, multi-dimensional insights and scenario simulations.

Use prebuilt analytical reports of key figures, including drill-down capabilities to the underlying transactional data.

Make informed decisions with real-time, multi-dimensional insights and scenario simulations.

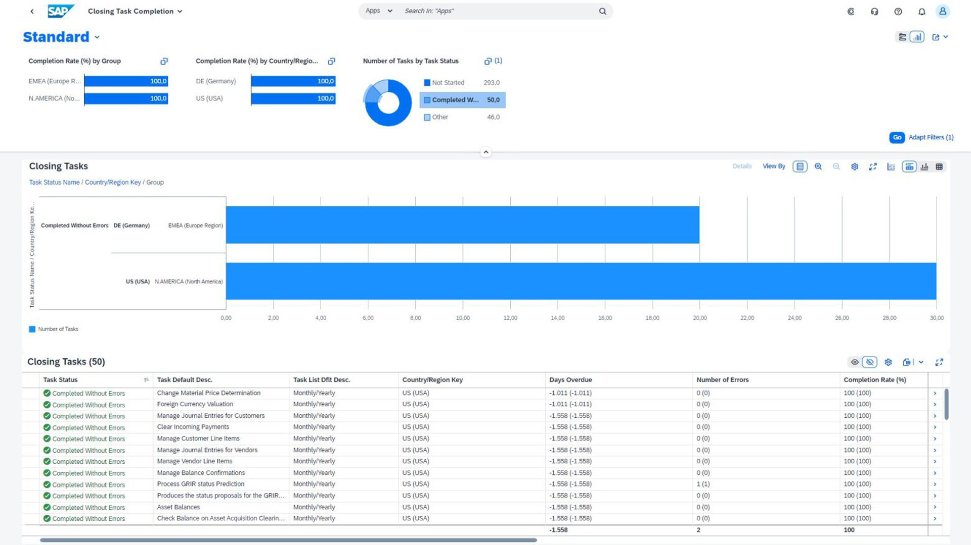

Accounting and financial close

Automation that streamlines accounting processes and improves accuracy

Integrate data and processes into one source that supports multi-GAAP principles and parallel ledger valuations.

Increase the efficiency and accuracy of your finance processes with automatic postings, situation handling, and built-in workflows.

Use AI-powered processes to orchestrate group consolidation and close processes to improve governance.

Increase the efficiency and accuracy of your finance processes with automatic postings, situation handling, and built-in workflows.

Use AI-powered processes to orchestrate group consolidation and close processes to improve governance.

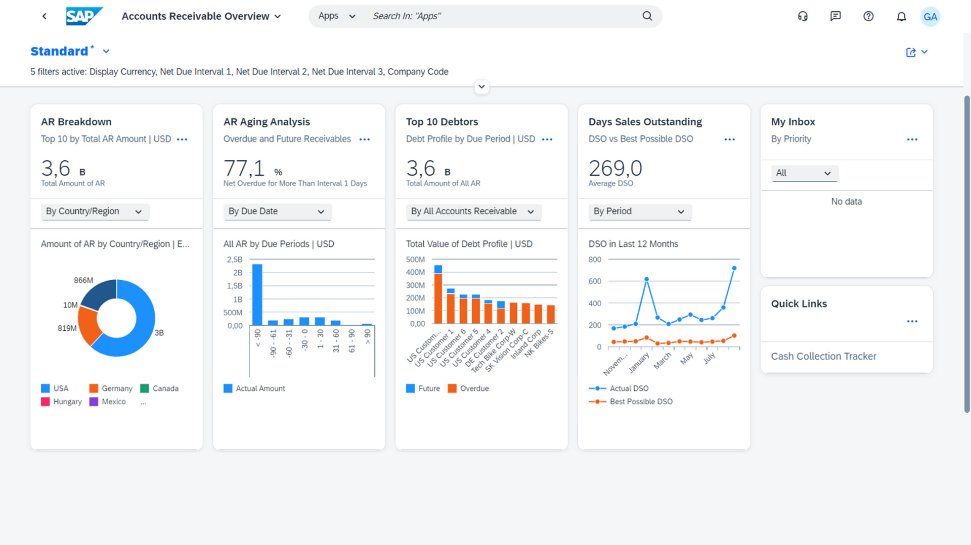

Automated & integrated Finance processes

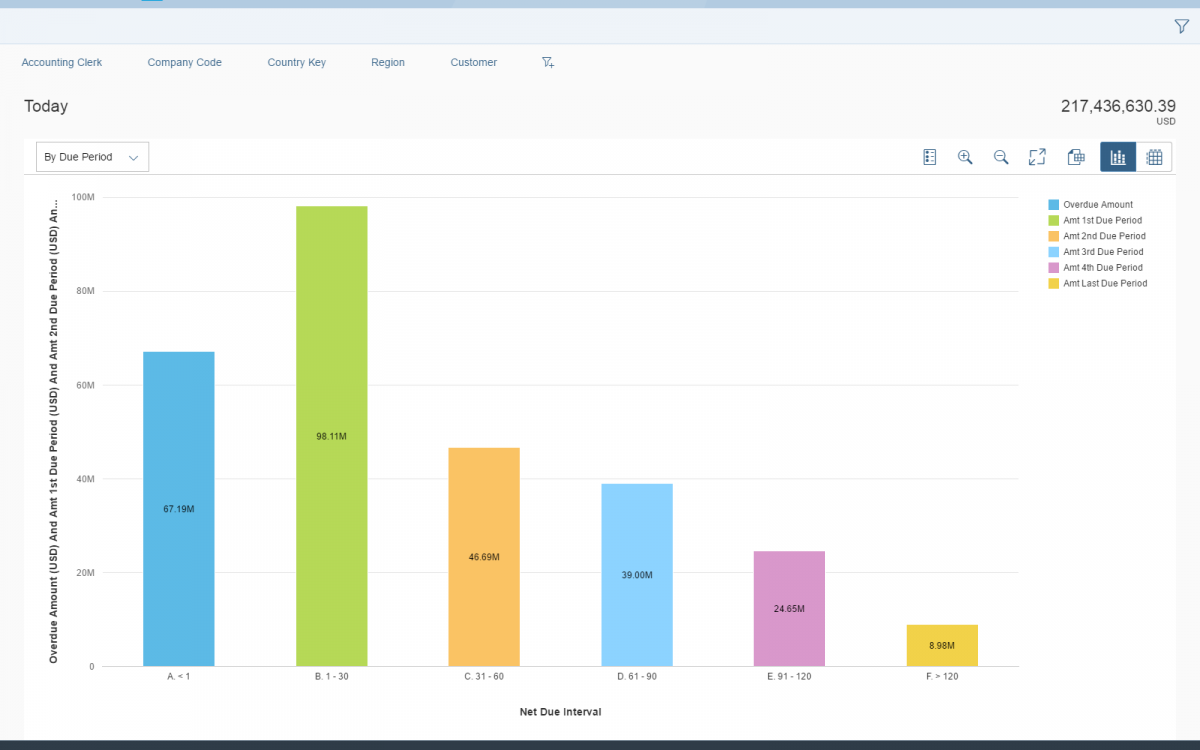

Efficient management of accounts payable and receivable

Manage open invoices and incoming payments, process dispute cases, and enhance cash collection.

Monitor the status of overdue payables, analyse invoice processing and aging, and forecast cash discounts.

Transform incoming payment processes with an AI-powered engine to automate clearing processes and reduce days sales outstanding.

Monitor the status of overdue payables, analyse invoice processing and aging, and forecast cash discounts.

Transform incoming payment processes with an AI-powered engine to automate clearing processes and reduce days sales outstanding.

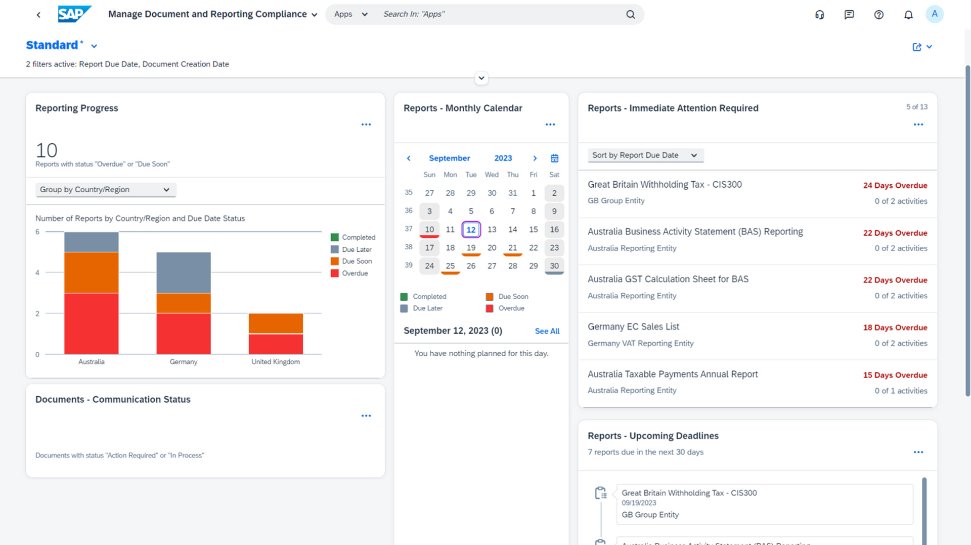

Financial compliance

More effective management of regulations with compliance, risk mitigation, and controls

Respond to new regulations using predefined statutory reports and handle corrections and tasks quickly.

Stay compliant by submitting obligations worldwide with a compliance calendar – from e-invoices to statutory reporting.

Manage potential risks with a control framework to develop and monitor safeguards and adhere to compliance and ESG standards.

Stay compliant by submitting obligations worldwide with a compliance calendar – from e-invoices to statutory reporting.

Manage potential risks with a control framework to develop and monitor safeguards and adhere to compliance and ESG standards.

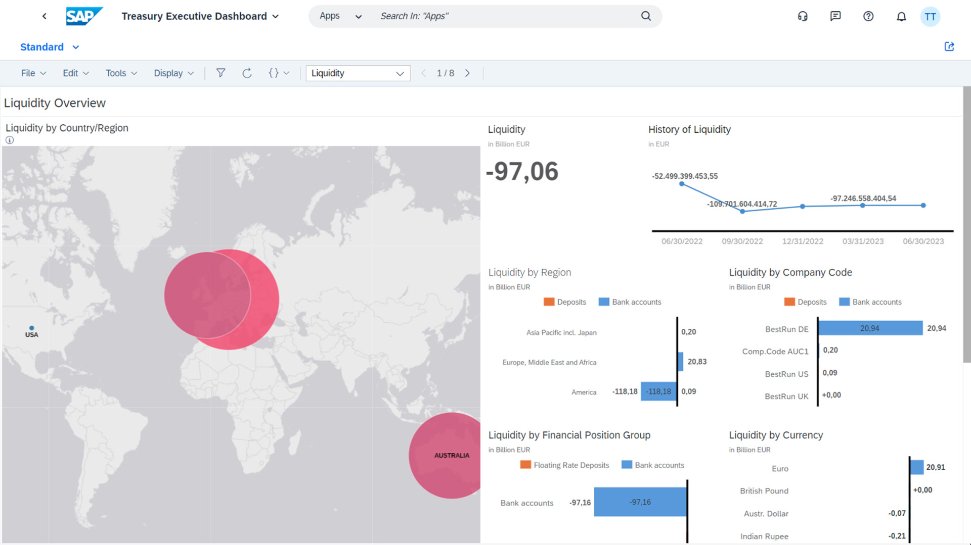

Treasury Management

Optimised working capital and mitigation of financial risks

Manage the bank accounts lifecycle centrally and monitor cash flow to optimise fund availability and utilisation.

Simplify and centralise corporate payments with in-house banking, rule-based workflows, and secured communication with banks.

Align business activities with regulations and mitigate risks with the ability to simulate threat severity and respond.

Simplify and centralise corporate payments with in-house banking, rule-based workflows, and secured communication with banks.

Align business activities with regulations and mitigate risks with the ability to simulate threat severity and respond.

en

en  de

de